BLOCKCHAIN, BLOCKCHAIN, BLOCKCHAIN!

Say blockchain one more time to me and I’m gonna puke. Honestly, from an esoteric technology only 3-4 years ago, to a blockbusting, life changing, world creating/devastating technology. Honestly, right now blockchain reminds me of the later 90’s dot.com hype.

Since the late 1990’s, we’ve seen multiple trends, starting with the late 90’s portals, the early 2000 video content sites, followed by the social networks, then to be followed by mobile apps – seems like every few years we have a new trend contender. The current one is by far – blockchain. It’s literally enough to add the word blockchain to anything to make it seem more valuable, cooler and probably – something worth investing in. Now, will blockchain will remain with us for the years to come, I truly have no idea – and I won’t even try to hypothesise. But, when talking about blockchain there are two terms that always come to mind: ICO and ITO.

The ICO (Initial Coin Offering) or ITO (Initial Token Offering) is a mechanism for companies to raise funds from the crowd – by a means of selling a “tangible” item that is supposedly worth something. To give a very rough concept, imagine that “Sausage Inc.” announces an ICO, allowing you to purchase coins for several dollars worth. Once the sale is complete, you can sell your coins for sausages, or you can trade your coins to another coin (yes, even bitcoin). Now, while “Sausage Inc.” may claim that a single coin may be worth 10 Sausages, the actual value of the coin is purely speculative – but, as with stocks and securities, I have no problem with people gambling their money away – the main problem I have is this – there is no way of telling if an ICO/ITO is real or not.

Very much like the start-up industry, the blockchain industry has its set of “expert story tellers”. But in this case, instead of telling the story to a group of savvy investors, capable of performing a proper due diligence – you tell the story to Mom and Pop, who eventually will cough up cash for the coin sale – without even knowing if the sale is true or not.

A few months ago a friend of mine called me up saying: “Dude, you gotta look at this ICO, they’re selling at $0.5, aiming to get to $28”. He was talking about a coin for the adult industry, oddly named: ZUBICOIN.

I was about to choke when I heard the name – and I indicated, this must be a SCAM. Why did I say that? simple, Zubi in Hebrew Slang normally refers to a situation when one tells the other: “You’ll get nothing from me”. So, a ZUBICOIN is actually a “Nothing Coin”. Indeed, when digging deeper we saw that it’s most probably a scam, and then a couple of weeks later the entire thing got flagged as a scam – internationally. But, it didn’t stop the scammers from cashing out a little bit on Mom and Pop who got fast into the $0.5 coin sale frenzy.

The funny bit was this – if you went to the zubicoin ICO website, you would get all the information you needed in order to make a proper investment: A business plan, a vision, the dreaded white-paper (TL;DR) and all the relevant information, even the names of the people involved – it actually looked legit.

So, I decided to have a look at Linkedin to see, are there “blockchain story tellers” these days? well, I found multiple companies to help you “push your ICO” and some even will write up your “White Paper”. So, I decided to go on some Telegram groups (most of the Crypto people are on Telegram). Amazingly enough, you will find people who can easily build you a blockchain, build you the ICO concept, build the content, tell your story – all for less than $20K – and you will have a valid looking ICO/ITO, and they don’t care if it’s a scam or not – because they are not responsible.

This reminded me of the early days of wholesale VoIP, when a certain company sent spam emails saying: “But a Cisco 5400 and make thousands of dollars a month selling VoIP”. They kind’a neglected the fact that the people will get arrested and fined for violating laws in some countries, but who cares about that.

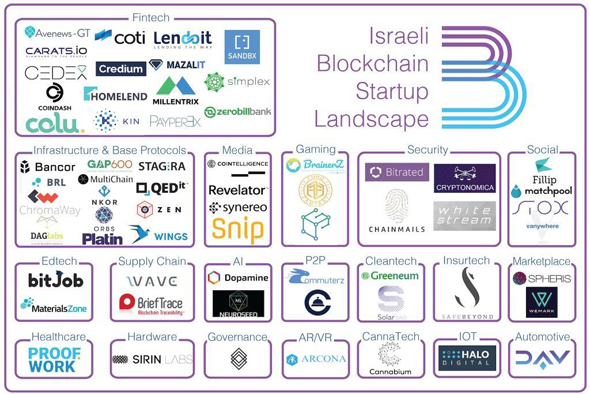

I truly believe in blockchain as a technology and I do believe we’re still a few years away from making it truly viable – so any startup that puts the blockchain buzz on its plan is automatically painted in my book as “suspicious”. In Israel alone, there are over 60 different companies branded as “blockchain companies”.

The above image isn’t up to date, as there are more companies.

So, I decided to create my own little list of check-marks for investing into a blockchain company, and here it is:

- Does the company deal in financial services? Do they provide a security or a utility?

- Does the problem presented on the website makes sense for blockchain technology?

- Is the industry presented prone to multiple fraud or a high risk of scamming?

- Do I truly understand what the company does? can I explain it in simple terms, without reading a 50 page white paper?

- Is the company fully candid or are they hiding in plain sight? can you tell who are the people involved in the company? can you truly say you believe them?

And even these aren’t a fail safe from wasting your hard earned cash. Take a look at this coin chart (not gonna tell what coin this is):

This token initially started at $0.016, climbed to around $0.24 per token – representing a market cap of over $600M for the company, only to rapidly fall. Today, its valued at around $0.024 – and judging from the app downloads, I suspect it will eventually wither and die, as the market will loose interest. They raised over $20M from the coin sale – but it goes nowhere from there.

In other words – examine your blockchain investments really well – they normally make cash to the “token/coin seller” only at the end of the day.